The financial industry wasn’t built for customers. Different types of financial products are deeply siloed in ways that don’t make sense to people who have money they want to spend and save. Rize is an app targeted at millennial couples who are just starting to figure out how to combine assets and save for the future. Rize provides spending, saving, and investing capabilities all in one app. Each member of the couple decides what is kept personal and what goes into the shared account. Share the rent bill, and keep your $5 latte habit to yourself.

I worked as the sole designer on the project over the course of a year. I worked closely with the engineering and growth teams to provide wireframes, UI mocks, and interactive prototypes. I performed exploratory interviews and evaluative testing with users.

A new way to bank together. Build the life you want as a couple, while maintaining your independence.

Pay Yourself First

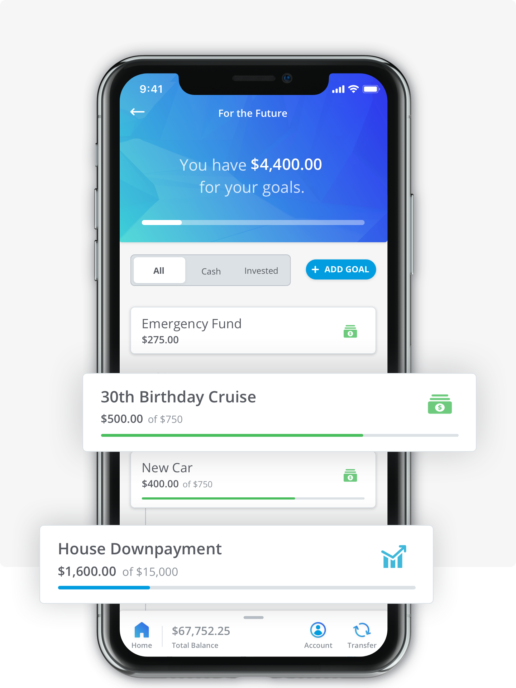

Rize uses an intuitive model that encourages people to put money away for the necessary stuff before they can even think about spending it. When you deposit your paycheck into Rize, you decide how much of it you want to put towards bills, spending, and savings goals. Then, every time you get paid, you know that what’s in your spend account is really available to spend since your bills have already been paid and your goals have already been funded.

Save and Invest Purposefully

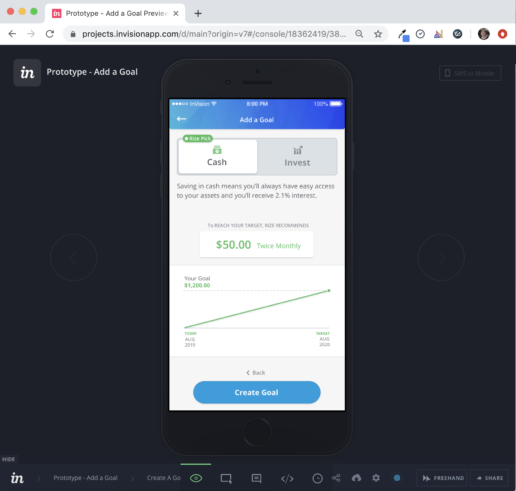

Instead of putting money away for the future in an abstracted way (like a percentage of your paycheck), Rize tries to make saving more meaningful. Goal-based saving and investing encourages you to think about the purpose of money you’re putting away. When you tell Rize what your target is, the app will recommend the best way to get there.

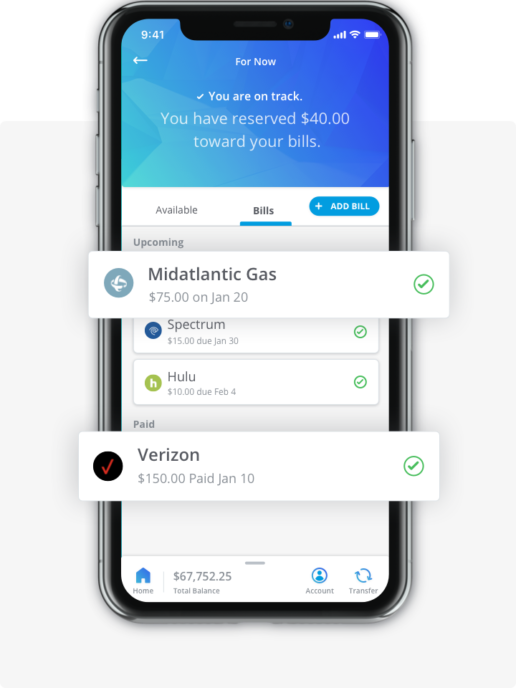

A Better Way to Autopay

Paying bills with Rize works similarly to goal-based saving and investing. When you connect your bills with Rize, the app will pull the correct amount for each paycheck. Then when the bill comes due, you’re never left scrounging around for the cash to pay it. Figuring out how to balance the spending between a couple is complicated. If you tell Rize what percent of the bill each partner should pay, the app will do the math for you.

All illustrations by Dinos & Teacups.

Driven by Real Insights with Couples

Over the course of the first few months of the project, I spoke to 7 couples about how they structure their finances, their biggest financial struggles and fears, and what could help them ‘do better’ financially. These interviews were synthesized and shared out with the entire team, providing real context for the work. These interviews also helped shaped the product direction. While the team initially assumed at the outset that everyone wanted their money magically managed for them, I found that often at least one member of the couple really enjoyed budgeting and the act of organizing their finances. This insight shaped the allocation screen — a place where customers can arrange their budget holistically.

"I am an economist and I don’t know [about financial packages]."

-Interviewee on the difficulty of managing her finances

Strategy: Take the Worry Out of Saving

Even for those people who enjoy putting together a budget, no one enjoys the complexity of the current state of financial products. Rize works to educate on and elucidate the saving and investing process by providing recommendations based on when you want to spend your money rather than abstract ideals. Want to go on a cruise next year? Better to save the money in cash to avoid risk and maintain easy access to the funds. Hoping to put some funds away to retire in 30 years? That might be an opportunity to try out investing with more time to smooth out the risks of the market. Making that simple for our users required a significant amount of flows and business logic in order to account for all the possible cases a user might experience. On the front end, the saving and investing process felt understandable, simple and approachable.

Getting Feedback: Remote Usability Testing

To validate our assumptions, I conducted remote unmoderated user tests throughout the design process. As I refined the design for new features, I created InVision prototypes to test with potential customers. This type of rapid testing ensured that the UI was as understandable as possible.

Unfortunately, due to unforeseen complications with a vendor, we were unable to launch the Rize application. The company shifted strategic direction to support a business rather than consumer client. Perhaps the application will surface again as a white label application for a business client!